Qualcomm Stock: Attractive Valuation After Impressive Q1 Earnings

Investment Thesis

Qualcomm (NASDAQ:QCOM) has experienced a substantial price appreciation recently due to impressive earnings and increased guidance. The company has experienced substantial growth in 2021 and projects the trend to continue into 2022. Qualcomm is not the same company that it was under Steve Mollenkopf and should not be valued using the same multiples that it was during 2019. They have successfully diversified their business and are no longer dependent on the cyclical mobile phone market for growth. Qualcomm will continue to grow beyond 2022 by continuing to expand their customer base and remaining competitive within several new industry segments that have an incredible growth runway. Based on my DCF analysis, which takes advantage of Qualcomm’s detailed future guidance, I believe Qualcomm continues to trade below its fair value and offers investors a great option when looking for growth at a reasonable price.

Company Overview

Qualcomm is a fabless semiconductor company that specializes in developing low-power/low-latency chips with high performance and speedy connectivity. They helped develop and lead the 3G, 4G and 5G revolutions, creating the wireless technologies that we have today. Qualcomm operates in two segments. The first being their QCT (products) segment which derives revenue from product sales in handsets, RF front end, automotive and IoT markets. The second being their QCL (licensing) segment which derives revenue from royalties for the use of their patent portfolio, which covers many of the fundamental technologies used in mobile communication. Historically, Qualcomm has derived most of their QCT revenue from the Snapdragon line, an integrated system of chips for mobile phones. However, their new CEO Cristiano Amon has focused on leveraging the company's technological expertise to diversify their business. For more information regarding Cristiano Amon’s vison for the future of Qualcomm, I would recommend reading this interview.

Industry Overview

Qualcomm's QCT segment competes in a highly competitive environment against the likes of Broadcom (NASDAQ:AVGO), MediaTek (OTCPK:MDTKF), Nvidia (NASDAQ:NVDA), NXP Semiconductors (NASDAQ:NXPI), Samsung (OTC:SSNLF) and many more. Qualcomm has succeeded in the past by controlling a large share of the high-end market that prioritizes benchmark performance. By consistently achieving industry-leading benchmarks, Qualcomm has been able to create an environment where mobile OEM companies are required to buy Qualcomm’s products in order to compete in the high-end market. Therefore, Qualcomm’s market share and profit margins within the QCT segment are dependent on their continued ability to set industry-leading benchmarks, allowing them to differentiate themselves from the competition.

DCF Model

With that being said, my primary focus for this analysis will be presenting my base case DCF model for Qualcomm after Q1 earnings. By describing the assumptions I made in order to arrive at an implied share price, the reader will be able to decide the feasibility of this scenario and the attractiveness of Qualcomm shares.

Sales

The first step in the DCF model was to accurately forecast future sales. Qualcomm has a diversified revenue stream with different growth rates per segment. These segments are summarized below for the past 3 fiscal years and trailing twelve-month period which includes the most recent Q1 numbers.

Forecasting a company’s future sales is not an exact science. Fortunately, during Qualcomm’s Investor Day in November they released targets for each revenue segment. I have summarized these projections below and will use them as the base for the DCF model:

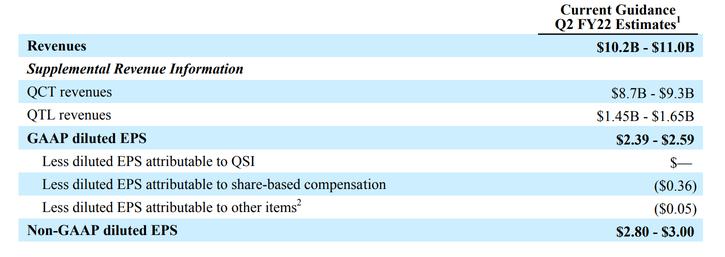

Additionally, Qualcomm gave guidance for their Q2 FY2022 numbers in their recent Q1 earnings report summarized below:

Using the first half FY 2022 estimates from Qualcomm, I project the full-year 2022 results below:

Qualcomm’s handset sales experience seasonality as their major OEMs concentrate their new phone releases around the Chinese New Year (Q2) and the beginning of the holiday season (Q4). Attached is a section from their most recent earnings call transcript which gives some color on the situation:

To project periods beyond FY 2022, I took a simple and conservative approach. After inputting the FY 2022 numbers from above, I projected growth that matched Qualcomm’s CAGR targets from their Investor Day. Below are my sales projections for the next three fiscal years which will be used in the DCF model:

Assumptions

For the QTL segment, I project Qualcomm to maintain their current revenues going forward. The large decline in this segment from FY 2019 and smaller decline in FY 2020 are the results of one-time payments made to Qualcomm in those years to settle multiple legal disputes.

For handsets, I matched Qualcomm’s 12% CAGR into 2024 following their Investor Day target. This growth is front loaded as Qualcomm continues to benefit from high demand for their 5G technologies in the current year.

For RFFE, I take the same approach and project 12% CAGR into 2024 following their Investor Day target.

For the Automotive segment, I project the growth rate to accelerate beyond FY 2022 as they ramp up sales to $3.5B by FY 2026. Qualcomm continues to form important partnerships throughout the auto industry leaving the segment with a large runway for future growth.

Lastly IoT, which is the segment CEO Cristiano Amon believes has the largest potential for growth, has 21.3% CAGR into 2024, projecting slightly over Qualcomm’s target of $9B sales in the segment by FY 2024.

Now looking at the big picture, my FY 2024 sales forecasts of $47.6B represents a 3.5% premium compared to the $46B mentioned by CFO Akash Palkhiwala during Investor Day. Additionally, my projected QCT segment growth rate of 14.9% CAGR is in line with Qualcomm’s projection of a mid teens CAGR for the segment.

EBIT

With decently accurate sales projections for the next 3 fiscal years, it’s time to project future EBIT. During their Investor Day, Qualcomm mentions that the QCT segment will have 30%+ operating margin going forward. Meanwhile, the QTL segment has generally maintained a 70%+ operating margin. Qualcomm also projected non-GAAP operating expenses to be between 21% and 23% of sales. With that in mind, below are my projections using the revenue numbers from earlier:

Even with R&D and SG&A significantly reduced as a percentage of sales, their gross amount did increase due to Qualcomm’s revenue growth. This leaves Qualcomm with an impressive 34.9% EBIT margin for FY 2022, in line with their first quarter results.

WACC

My DCF will use a WACC of 7.88% calculated below:

Enterprise Value

For my Unlevered Free Cash Flow calculation, I used EBIT from above and subtracted taxes of 14% for the current year but used 16% for following years. I assumed Depreciation and CAPEX will both increase by minuscule amounts, as Qualcomm grows, and that Net Working Capital will remain flat going forward. Below are my results from the DCF calculation:

Price Target

Using my base case projections, I have an implied share price of $207.86 which represents a 15.82% upside from where Qualcomm was trading at the close on February 4, 2022.

Sensitivity Analysis

To alleviate the risk of rising interest rates on my model, below is a sensitivity analysis chart tracking my implied share price as my WACC value changes.

As a reference, to get an 8.5% WACC, my risk-free rate would have to change from the current 2.3% to 2.97% and to get a 9.5% WACC, my risk-free rate would be 4.05%.

Risks

Qualcomm faces two main risks that could materially impact their growth. The first risk is the rise in popularity of vertical integration of mobile OEM companies. Apple has spearheaded this movement, but Google and Samsung have both produced products that, in some instances, are used within their phones. Furthermore, the Chinese government continues to heavily subsidize semiconductor research domestically to minimize their reliance on foreign partners. Investors should be aware of the Made in China 2025 plan in which China strives to have 70% of their semiconductors produced domestically by 2025. Although this is the biggest risk facing Qualcomm, producing high-performing 5G products will remain a capital- and IP-intensive undertaking with high barriers to entry. Furthermore, Qualcomm has shown a consistent ability to set top-tier mobile benchmarks for their Snapdragon brand and this market will not disappear overnight.

The second risk facing Qualcomm’s growth is their heavy reliance on the Chinese mobile market. If U.S./China trade relations deteriorate or national security protection policies are initiated, Qualcomm may be negatively impacted.

Final Thoughts

With the inevitable advancement of cloud computing, seamless wireless communication will develop new use cases and growth drivers. Over the long term, Qualcomm is perfectly positioned to leverage their technological expertise to diversify away from the mature mobile markets into other emerging markets that remain in early innings of development. Qualcomm trades at a discount to its fair value and remains a great option for investors looking for growth at a reasonable price.

- Prev

- Next