VNET Group Stock: A Speculative Investment Makes Sense (NASDAQ:VNET) | Seeking Alpha

The thesis in a nutshell

If you think the industry for cloud-computing and data-infrastructure in China will outperform the market, then an investment in VNET Group (NASDAQ:VNET) might be an attractive bet.

From its all-time high in February 2021, the stock has sold off more than 81.3% and volatility (Implied Volatility) has skyrocketed to 105%. Selling put options on this company's stock, which financial numbers are healthy, might give you an excellent risk/reward opportunity and an annualized return of 39%.

About VNET

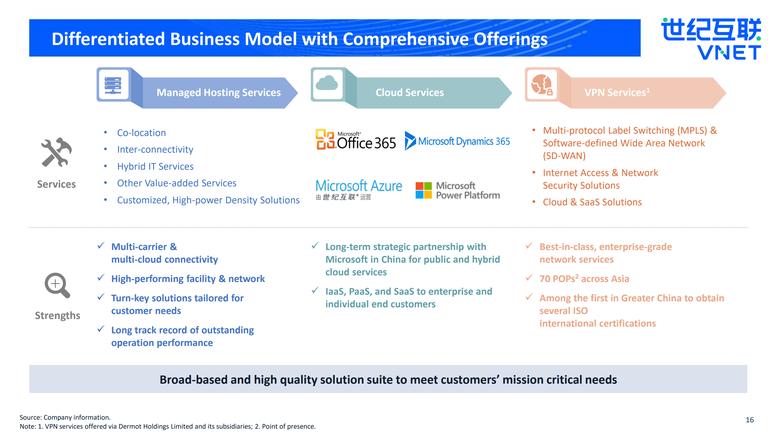

VNET is a leading carrier- and cloud-neutral data center services provider in China. The company operates 32 self-built data centers and 52 partnered data centers with an aggregate capacity of 53,553 cabinets under our management as of December 31, 2020. Most of VNET's data centers are concentrated in tier-1 cities and their surrounding regions, which have favorable demand dynamics, owing to dense internet traffic, scarce resources and high demand for data center facilities. Here is a rough overview of the three main services provided by VNET:

● Managed Hosting Services consisting of managed retail services and managed wholesale services;

● Cloud Services that allow businesses to run their applications over the internet using our IT infrastructure rather than having the infrastructure on their own premises;

● VPN Services that extend customers' private networks by setting up secure and dedicated connections through the public internet.

In it's respective market, VNET is a big player. With a nationwide data center network and comprehensive service offerings, the company has attracted more than 6,000 enterprise customers. Multiple well-known companies in China have chosen VNET as a partner to help them accelerate their digital transformation, including JD (NASDAQ:JD), Alibaba (NYSE:BABA), MOMO (NASDAQ:MOMO), Tencent (OTCPK:TCEHY)and Xiaomi (OTCPK:XIACF). Some of the international companies that collaborate with VNET are Microsoft (NASDAQ:MSFT), BMW (OTCPK:BAMXF), Toyota (NYSE:TM), to name a few. Notably, the company is not financially dependent on any single or a basket of customers. In fact, the top 20 customers represent only approximately 37.7% of total revenues as of Q3 2020.

The Opportunity

I am writing about VNET because I think an investment in the company provides exposure to a huge market opportunity. We all know the market for cloud computing is growing at a fast pace. And COVID-19 has strongly accelerated the trend towards digitalization. I believe VNET's scale and business model is attractively positioned to capture the vast opportunities in this rapidly expanding market of internet and cloud computing infrastructure services in China, which is expected to grow at 10.5% CAGR until 2030.

VNET has structured a 'Dual-Core' growth strategy to capture the opportunities in the market for cloud-computing and data-hosting. One piller is represented by the partnership with hyperscalers -- big tech-giants that require a huge data infrastructure for their services (Alibaba Cloud, JD Cloud, Huawei Cloud, Tencent Cloud, etc.). The second pillar is represented by a diverse collection of services connected to the industry 4.0, which require data storage and cloud computing (autonomous driving, blockchain business models, the gaming / streaming indusry, etc.)

Interestingly, in late January 2022 Blackstone Tactical Opportunities (BX) agreed to make an investment in VNET through the purchase of $250M of convertible notes. The notes have a five years term and carry annual interest of 2%; they are convertible into ADSs witha strike of $11, and thus represent a premium of approximately 35% to latest closing price. While as a shareholder of VNET I am not fully convinced about the financial merit of the deal for VNET, for me the deal confirms a favorable bullish bias for the company. Blackstone arguably is the most successful private equity group in the world and when they invest, they usually achieve abnormal returns (thus Blackstone is definitely aiming for a equity conversion, showing confidence in VNET's growth potential).

In my opinion, VNET's business activities have huge potential for shareholder value generation. But currently the market doesn't seem to fully agree. From its all-time high in February 2021, the stock has sold off more than 81.3%.

Let us look at the financials to evaluate if the sell-off is justified based on business fundamentals.

Financials

Whenever I like to make a long-term equity investment, I look for three key features: Revenue growth, strong operating cash flows (business profitability), and a healthy balance sheet. While VNET does not fully convince with operating cash flow (business profitability), the company has attractive revenue growth and a relatively healthy balance sheet.

First, let us start with the income statement. In the period 2017 until 2020, revenues grew from $521.4 million to $740 million, implying a compounded annual growth rate of 8.15%.

(Note that the operating profitability numbers of 2020 must be adjusted due to a one-time loss in non-operating income.)

As mentioned, the business profitability doesn't fully convince. While the adjusted EBITDA margin is at 29.6%, the company isn't net-profitable. In fact, ever since 2015, VNET recorded losses. The operating cash-flow, however, gives a slightly better picture, calculating a cyclically adjusted 3-year average of approximately $109m.

A green light is coming from the balance sheet. As of late 2021, VNET records $592.4 million of cash, which is 45.8% of the company's market capitalization ($1.29 billion). Total debt, on the other hand, remains stable at a manageable $2.5 billion.

Valuation

DCF Calculation

Let us look at what could be a reasonable price target for the company. I have constructed a DCF valuation with a sensitivity analysis of key assumptions. The results of my analysis are termed Base-, Bear-, and Bull Case. (Some assumptions for the analysis are listed under the respective case).

As you see, VNET's fair value depends on the analyst's subjective opinion. Expecting the base-case scenario, the company is relatively fairly valued at the current price. In the bear-case, the company isn't really worth anything. And expecting the bull-case, VNET should trade at a 696% higher valuation. Personally, I expect VNET's future somewhere between the base-case and bull-case scenario, based on the outlook presented in previous paragraphs. However, feel free to challenge my estimation.

Other analysts' valuation

A good reality check for my valuation provided is to look at how other analysts value VNET. The consensus confirms a bullish bias, with price targets between $11.5- $41.3 per share, and an average price target of $23.4 per share.

Some thoughts about risks

For VNET, of course, the usual sources of potential risks apply: The company could fail to execute the strategy and business plan; industry growth may not realize as estimated; competition might take market share; and technological innovation may outpace VNET's services. I argue, however, that the main risk presented is connected to polital / regulatory headwinds -- and highly likely this is the reason for VNET stock's crash of more than 80% in 2021.

I don't want to politicize the discussion or present myself as an expert on China, which is why I would like to encourage every investor to assess the risk-reward for investing in the PCR for himself. For me personally, the valuations are pushed to such low levels that I regard investments in China as justified, despite the possible risks.

Some thoughts about risks

Given the rapid growth of cloud-computing and the demand for data-service infrastructure in China and the accelerated push towards digitalization, I believe VNET Group is excellently positioned to take advantage of this secular growth narrative. However, I would like to note that VNET is not an appropriate investment for highly conservative and risk-averse investors. VNET is a speculative opportunity for those investors who like to buy into fear and feel comfortable with the characteristics of a high-risk/high-reward trade. As we have seen, reasonable scenarios could imply a range of possible target prices of -93% and +696%.

Finally, if the Implied Volatility on a stock is highly elevated, I like to complement my directional bias with the sale of either a naked put or a covered call. The IV for VNET, which has obviously skyrocketed amidst the unfavorable market environment, stands now at ca. 105%. Thus, selling the derivatives on VNET will greatly push the odds in your favor.

For reference, at-the-money put options with approximately 180 till expiration trade at $1.4.

- Prev

- Next